Rancho Las Palmas will Relocate from Escondido to an Intersection Owned Retail Center in San Marcos

Established Escondido Restaurant Rancho Las Palmas, has made the decision to relocate and executed a 10-year deal at San Marcos Square located at 160 S. Rancho Santa Fe Rd in San Marcos. Brokers Dan McCarthy and Alec Spencer facilitated the deal, leasing the entire 3,400 SF prime end-cap. Rancho Las Palmas will not only have premier visibility from the window-lined suite but ample parking, with entry accessible from both Rancho Santa Fe Road and Grand Avenue.

Offering authentic coastal-Mexican cuisine with traditional dishes like agua chile and ceviche, Rancho Las Palmas is excited to begin the build-out process for their new space. With plans for a kitchen, bar, indoor and outdoor seating options, and private event space. The restauranteur is excited to elevate their previous location with a bright and colorful design and an open concept dining space.

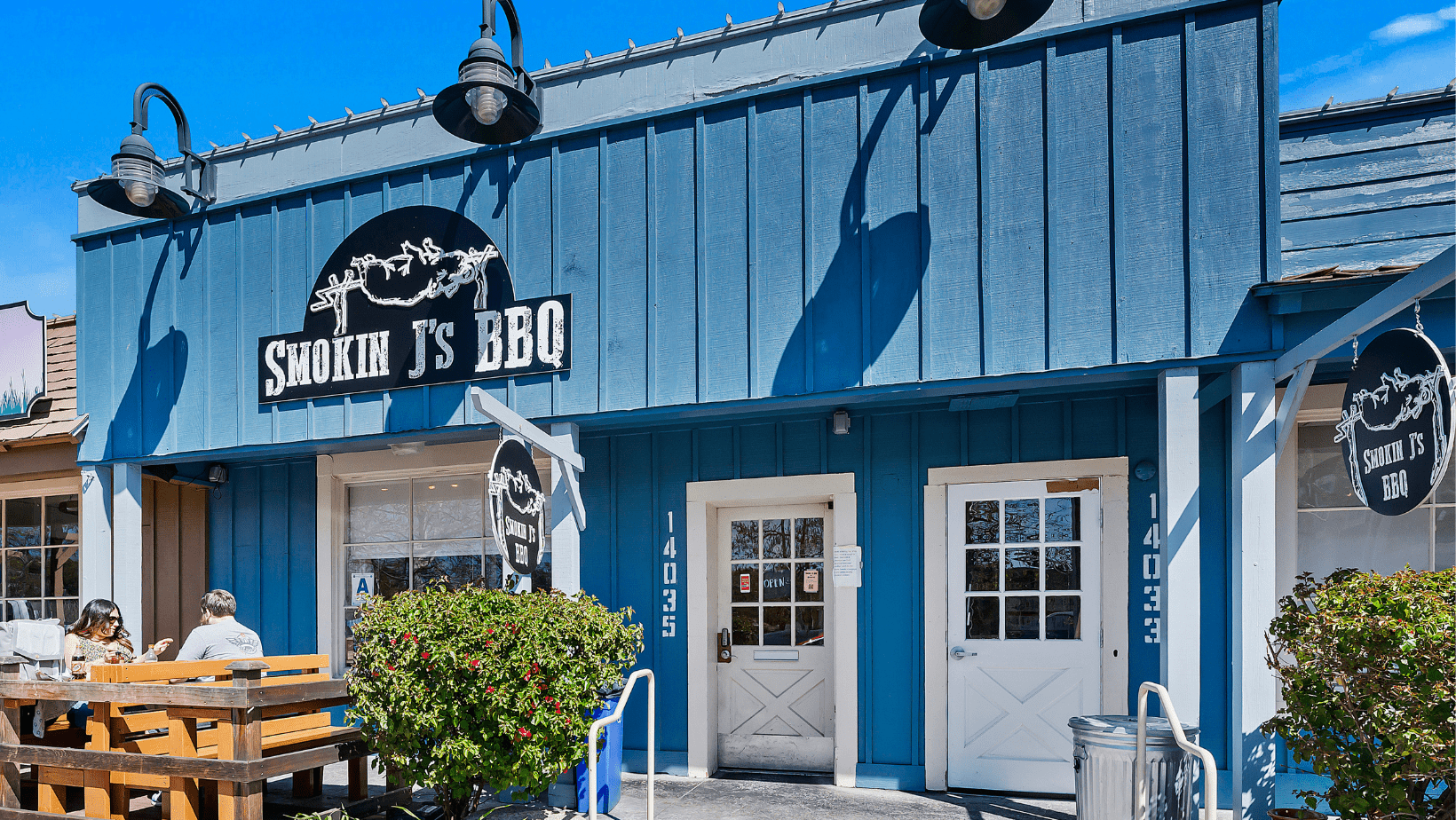

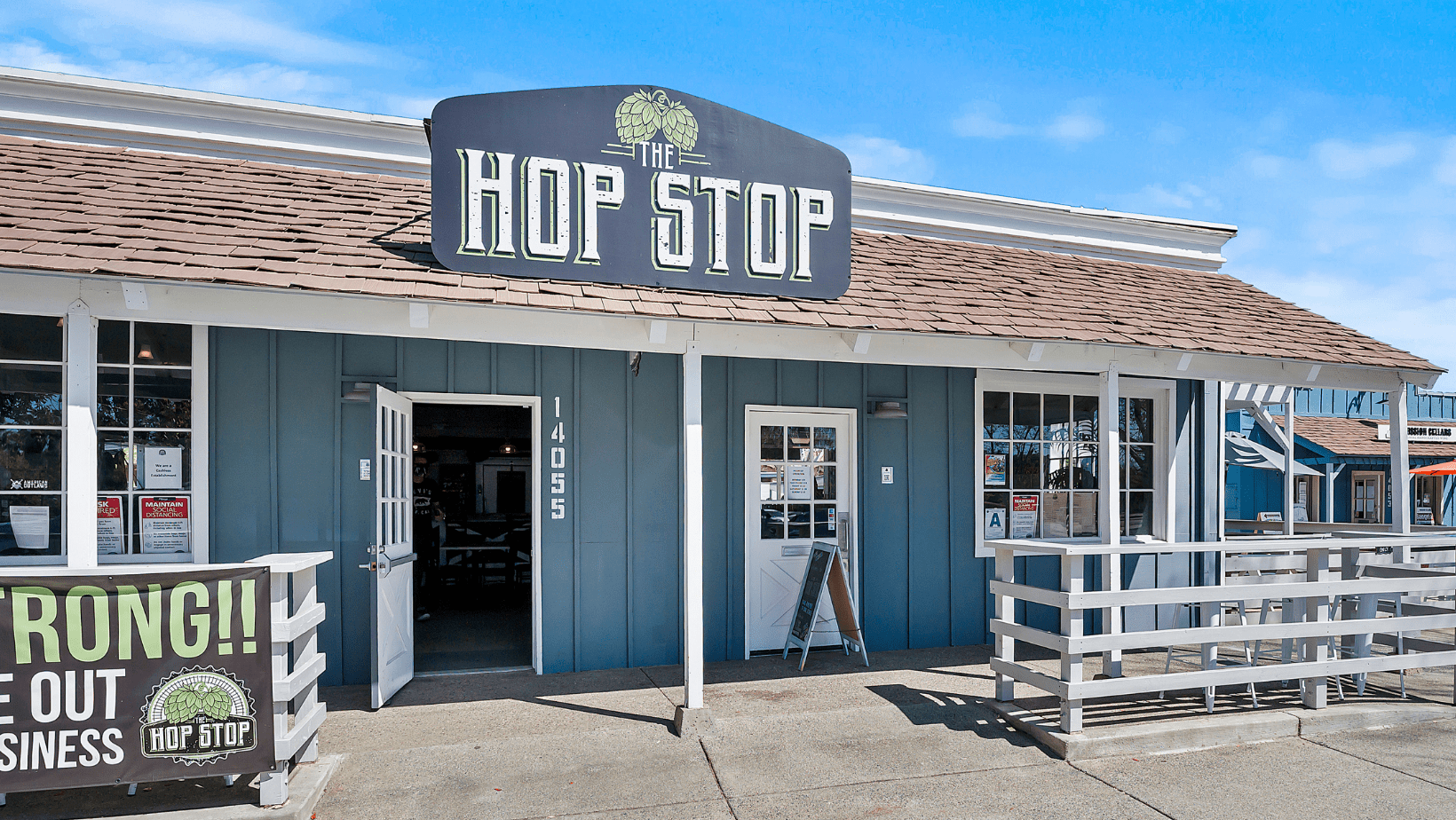

As an internally owned property under Intersection Investment Management, San Marcos Square is a redeveloped retail center with a strong and harmonious tenant mix of both celebrated local tenants and national credit users like Sunnyside Learning Center and US Bank.

With an anticipated opening of January 2023, Rancho Las Palmas will not only increase the center’s overall foot traffic but will undoubtedly complement the surrounding community. This new lease is the last important step in the value-add program that Intersection set out to achieve with the center.

“We’re Thrilled to have found a tenant with such a great history in San Diego to relocate to our Center”, says Mark Hoekstra, Managing Director with Intersection. “Rancho Las Palmas will become a place for locals in the area to meet and enjoy great food”

To learn more about this deal please reach out to Dan McCarthy at [email protected] or Alec Spencer at [email protected]

Autumn Valencia is the Marketing Coordinator at Intersection, providing strategic marketing expertise to support business objectives across company divisions. For general and marketing inquiries, please contact Autumn at [email protected]