THINK 2.0: Intersection’s Updated Market Selection Methodology

In a world characterized by uncertainty and rapid change, the ability to adapt and innovate becomes paramount. At Intersection, understand the significance of staying ahead of the curve. Our journey began in 2020, a year marked by the COVID-19 pandemic. A year that compelled businesses into lockdown and sent shockwaves through the market. During this period, we made a pivotal decision—to reflect on our commercial real estate investment strategy and pioneer a transformative approach to market selection.

THE CONCEPTION

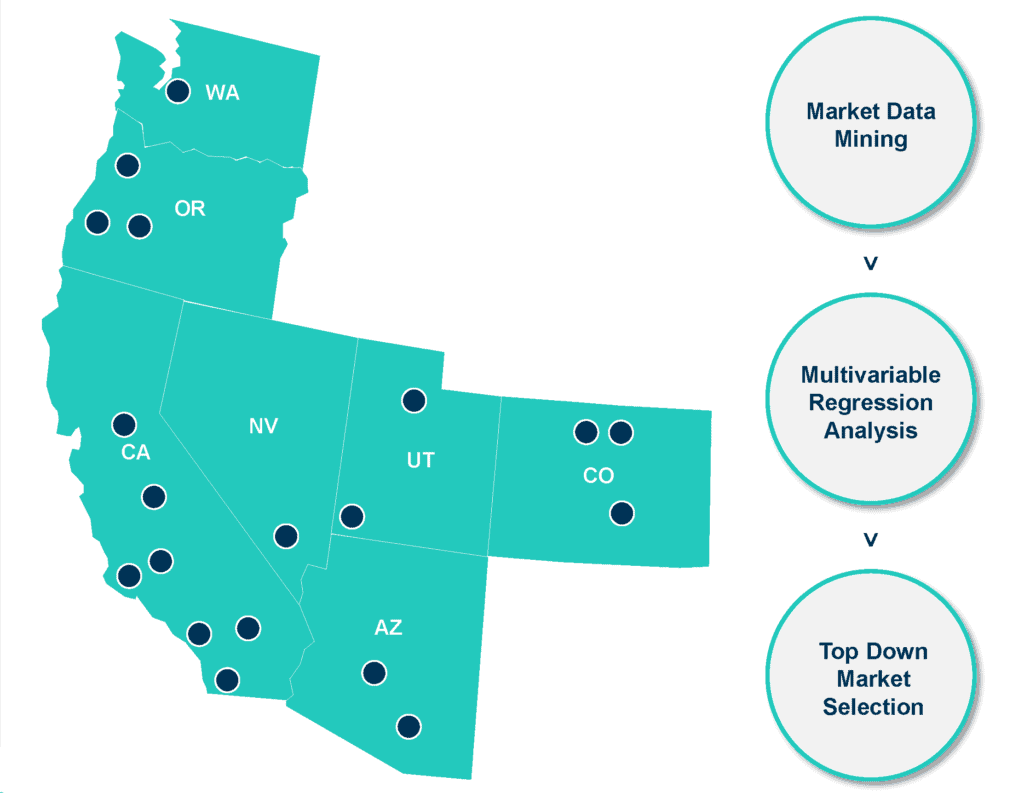

This introspection gave rise to THINK, a dynamic and data-driven market selection methodology with a clear mission: to identify industrial markets poised for exponential growth. THINK emerged as the cornerstone of our investment thesis. Guiding us towards acquiring over 500,000 square feet of industrial real estate in just three years.

The genesis of THINK was rooted in a deep understanding of the driving forces shaping the industrial real estate landscape. Two key factors became conspicuously evident, further magnified by the onset of the pandemic—onshoring/reshoring of manufacturing and the rise of e-commerce.

Before 2020, onshoring/reshoring of manufacturing and e-commerce was already gaining momentum. However, the disruption in global supply chains triggered by the pandemic sent shockwaves through the corporate world. In turn, companies had to reassess their global footprints, questioning the tradeoff between lower costs and operational resiliency. For many, the pandemic underscored that sacrificing resiliency for cost savings was a risky proposition. This paradigm shift hastened the onshoring of manufacturing, buoyed by legislative incentives, driving up the demand for logistics space in strategic U.S. markets.

Furthermore, e-commerce, a growth phenomenon even before the pandemic, soared to new heights. E-commerce revenues surged by over 100% in the preceding five years, with the pandemic pushing it to new peaks. In the second quarter of 2023, e-commerce sales constituted a significant 15.4% of total retail sales, signifying a profound and lasting change in consumer behavior. Given that e-commerce retailers require approximately three times more logistics space than their brick-and-mortar counterparts, demand for such spaces quickly outstripped supply in many markets.

THE EVOLUTION OF THINK 2.0

Recognizing these shifts in the industrial real estate landscape, we resolved to identify high-growth markets based on objective data and demographics. Thus, the THINK framework was born, a data-driven market selection methodology fueled by multivariable regression analyses and a weighted ranking system. THINK became our guiding light for the past three years, and we’ve been tirelessly refining it ever since.

Today, we are pleased to introduce THINK 2.0—the latest evolution of our market selection methodology. THINK 2.0 incorporates a series of enhancements to our analysis:

1. Implementation of a second regression utilizing an additional dependent variable.

2. Addition of a liquidity metric to account for market depth and transaction activity.

3. Refinement of data curation and variable selection.

4. A streamlined ranking and scoring system designed to eliminate statistical noise.

Since 2020, our investments in markets identified by THINK have borne fruit. Consistent leasing demand and rental rates that exceed proforma projections as a result. Consequently, we’ve completed a full cycle on one industrial asset and are on track to meet or surpass our projections for the other assets currently in our portfolio.

In the ever-evolving landscape of commercial real estate, we are committed to staying at the forefront, shaping the future of the industry. THINK 2.0 is a testament to our dedication to innovation and our unwavering pursuit of success.

To learn more about this Intersection’s Market Selection Methodology, please reach out to Anton Myskiw @[email protected] or Ethan Okazaki @[email protected]