Mercado Rancho Bernardo Named First Retail Center to Earn the Prestigious TOBY® Award

Intersection is excited to announce that The Mercado in Rancho Bernardo has earned a historic achievement in commercial real estate as the first retail center to be named The Outstanding Building of the Year (TOBY®) Award in San Diego, by the Building Owners Management Association (BOMA). This accolade, traditionally bestowed upon office buildings, is a testament to our commitment to excellence in property management and operations.

The TOBY Award represents the pinnacle of recognition within the commercial real estate industry, honoring exemplary practices in building management across specific categories of building types or sizes. To even qualify for consideration, a property must first earn a BOMA 360 designation, triumph in local and regional competitions, and eventually emerge victorious at the regional level.

At The Mercado, our journey to this groundbreaking achievement has been marked by vison, innovation, and relentless pursuit of excellence. Over the years, Intersection has meticulously curated an international tenant mix that harmonizes to create an unparalleled experiential retail center. Our partnership with Intersection Facility Services has ensured seamless tenant improvements and project maintenance, elevating the property to new heights.

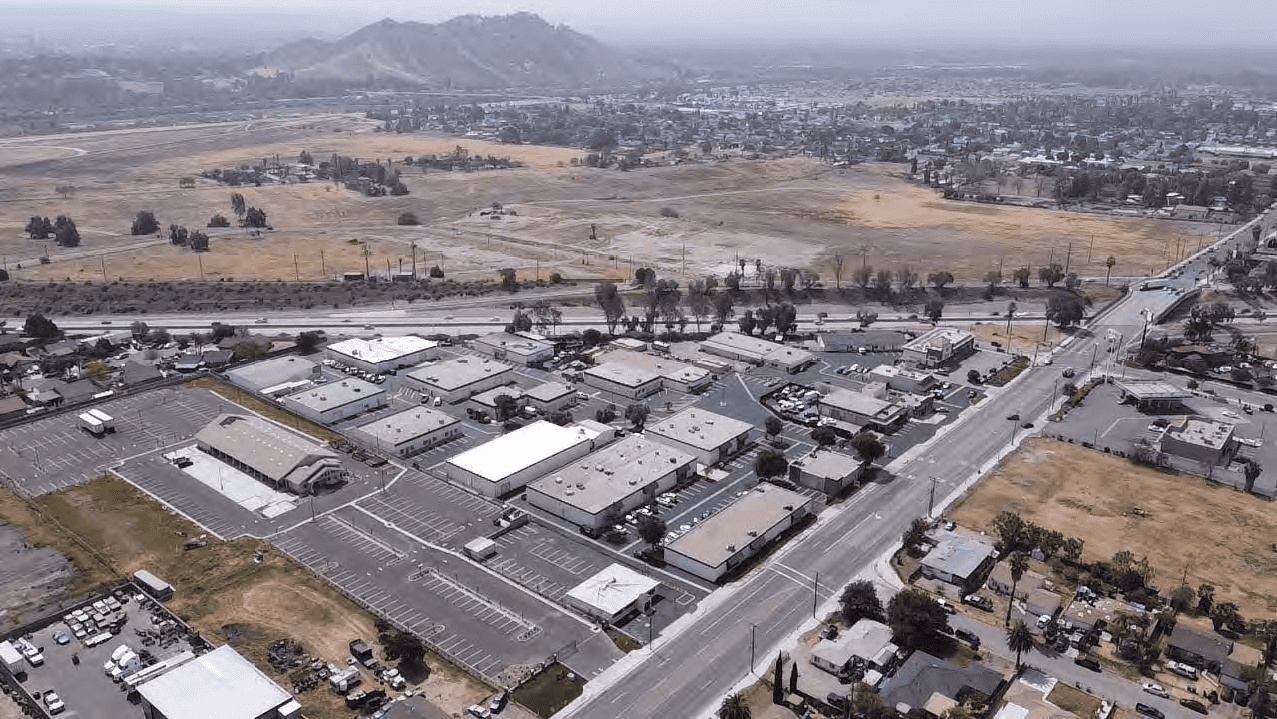

Situated in the heart of San Diego’s tech and innovation corridor, Rancho Bernardo serves as the backdrop for The Mercado’s success. The area boasts an impressive roster of major companies, including Amazon, Hewlett-Packard, Northrop Grumman, Sony, and the recent addition of Apple’s sprawling 67.5-acre campus. Conveniently accessible via I-15 with multiple entry points via Rancho Bernardo Road and Bernardo Center Drive, The Mercado stands as a community focal point, drawing in residents, office employees, and visitors alike. Coupled with a strong residential demographic component and proven retail traffic patterns, project ownership and management saw the potential to raise the shopping experience to a new level. Capital investment and creative vision have resulted in a unique project that is 100% leased.

What sets The Mercado apart is its commitment to excellence in every facet of its operation. From its very walkable accessibility, well-maintained landscapes, and prominent signage to the recent exterior enhancements accentuating its unique architectural features, every detail has been meticulously crafted to create an inviting and exceptional retail environment.

The judging criteria for the TOBY Award encompass an array of factors, including community impact, tenant and employee relations programs, energy management, accessibility, emergency procedures, personnel training, sustainability and overall excellence. The rigorous inspections conducted by industry experts validate the significance of this achievement.

Winning the TOBY Award underscores our dedication to delivering best-in-class operations and management. It is a testament to the hard work, dedication, and collaborative spirit of everyone involved in making The Mercado an unparalleled success.

We owe this momentous achievement to the vision, expertise, and collaborative efforts of an exceptional team. It’s with immense gratitude that we extend our thanks to:

-

Nicole Schuck and Sean Rafford (Intersection Real Estate Services): Their unwavering commitment to excellence have been the driving force behind The Mercado’s success. Your vision and dedication have steered us toward this historic milestone.

-

Nick Cardoso and Fernando Cruz (Intersection Facility Services): Their relentless efforts in handling tenant improvements and maintenance have been instrumental in elevating The Mercado to its current stature. Your attention to detail and commitment to excellence are truly commendable.

-

Dan McCarthy and Alec Spencer (Intersection Commercial Brokerage): Their expertise in curating a tenant mix that creates an exceptionally experiential retail center has been invaluable. Your insight and dedication have been pivotal in shaping The Mercado into what it is today.

-

Mark Hoekstra (President and Co-founder of Intersection): His guidance, vision, and unwavering support have been the cornerstone of the success at Mercado for nearly three decades.

Each member of this exceptional team has played an integral role in securing this prestigious recognition. Your dedication, passion, and unwavering commitment to excellence have been the driving force behind The Mercado’s triumph.

This recognition only fuels our commitment to continuous improvement and innovation. As we celebrate this milestone, we also look ahead, eager to continue setting new benchmarks in the commercial real estate landscape.

The Mercado in Rancho Bernardo isn’t just a retail center; it’s a testament to the power of vision, collaboration, and unwavering commitment to excellence. Thank you to everyone who has been a part of this incredible journey. Together, we’ve made history.

Join us in celebrating this remarkable achievement and experience the excellence that defines The Mercado.

To learn more about Mercado Shopping Center or the TOBY awards, please reach out to Nicole Schuck @[email protected]

Natalie Baylon is the Marketing Coordinator at Intersection, providing strategic marketing expertise to support business objectives across company divisions. For general and marketing inquiries, please contact Natalie at [email protected]